If you are reading the headlines about Obamacare lately you can’t miss the articles about how 2017 is going to bring significant increases in health care costs. Here are some of the headlines:

“The Pennsylvania Insurance Department says insurers have proposed premium increases averaging 23.6 percent for individual coverage for 2017.” (NY Times)

“Obamacare 2017: Health Insurance Costs are Ballooning – Texans’ Premiums Will Soar By Over 55%”

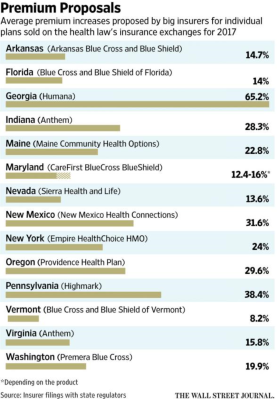

And according to the Wall Street Journal premium increase proposals for some states are as follows:

As I had mentioned in a previous blog these increases are not sustainable. That being said, I think the health care balloon is about to pop. And this is not just the exchange plans. It is the health care balloon which includes all plans. Let me explain.

Those in the health insurance business are familiar with the term “squeezing the balloon”. The implication is that when you try to control health care costs in one place it often pops up somewhere else. The cost of health care doesn’t go down it just moves from one place to another. The balloon gets squeezed but does not shrink. In fact, the health care cost balloon keeps on getting bigger and bigger.

For the past 20 or so years benefits brokers have been trying to help employers manage costs but have seen little success. For the most part there is very little a broker or an employer can do because there are simply too many things outside of one’s control to control costs over time. So the whole industry has mastered the art of helping employers find better risk pools. PEO’s try to attract employers by moving firms into a larger risk pool. Smaller and smaller employers have been moving to self-funded plans. Now we see “Captives” which is essentially a methodology of creating another risk pool. The idea for many of these employers is to get smaller employers out of small group community rates.

This idea of having all these different risk pools is quite interesting. Even the insurance companies create different risk pools. They have their individual insurance pools; their small group pools; and their large group experience rated pools. They put these employers in different buckets and mange those buckets. It almost seems like within a single insurer they have their own death spiral going on. By segregating their risks eventually, the smart companies or individuals will find a way to get into a better risk pool leaving the bad risks in another pool.

It is my belief that the government, and maybe society in general, will not let this persist. There are already complaints about the “game being rigged” resulting is income disparity. In some ways the health insurance game is heading in the same direction too, with different groups of people having much different experiences. I will not get into risk and underwriting here because it really doesn’t matter. If a large part of society can’t get affordable health insurance it is everyone’s problem.

The day may be coming where there may no longer be a place to hide. In a recent NY Times article Kurt J. Wrobel, Chief Actuary of Geisinger Health Plan stated:

“Our rates for Medicare, Medicaid and employer-sponsored insurance have been relatively stable, but those products have to bear the cost of our losses on exchange business,”

Geisinger requested a 40% increase for their exchange plans for 2017. If they don’t get it they have to make up for the losses somewhere else.

This health care cost problem is not going away. In fact, it is getting worse. I often tell my staff that when you see a problem staring you in the face, do something about it. The health insurance problem is staring us right in the face, right now, and if the industry doesn’t do something about it then someone else will. That someone in the U.S. is the government.

Many have said that the reason incomes are flat is because employers have been bearing the brunt of the health care cost increases over the past 5 years. Health care cost increases are consuming dollars that could be used to raise wages. Employees have been also getting hit with higher contributions for health insurance. Flat wages plus higher health care costs equals a negative income.

This problem is coming to a head. The balloon has no more capacity. Will 2017 be the “tipping point” that will force changes in unprecedented ways? I think so and there may be no place to hide.

You must be logged in to post a comment.