I want to start by saying that I am knowingly writing an article that is going to throw fuel on a fire. Being from New England this would be like writing an article in the Denver Post that says Brady is better than Manning. Letters will be written. Darts will be thrown. I know it so I will make sure I put on my steel vest before I publish. In fact I already started writing on this topic in a recent article titled, “Apple HealthKit – The Next Step to the End of Employer Based Health Insurance” that generated an emotional response from many. In this article I will provide a more detailed analysis of why the premise presented in my first article may come true. My core belief is that within 5-10 years employers will be out of the health risk business. I will then provide a plan for what I think benefit brokers should do to prepare for this possible change in the market. Taking action may be the difference between those that survive and thrive in this new health insurance world versus those that may struggle or even fail.

What do I mean when I say employers will be out of the health risk business? To repeat what I said in my last article, “by health risk I mean the cost of the employee’s health insurance will not be priced by employer. It won’t be a function of average age of the employee population, claims experience, or any of the standard underwriting/pricing rules today.” In fact, health insurance will most likely become an individually purchased product and the insurers of the future may not be the companies that dominate the market today. The players and the structure of the market will be vastly different.

As a consultant to benefits brokers, I educate them on technology and advise them on how they can maintain a competitive position. My own future is dependent upon brokers remaining significant so I am as concerned about their future as any broker would be. So for my own benefit and the benefit of my customers I am constantly “taking the pulse of the market” so that I can make the right business decisions. I do this by watching what I call “significant market moves”. Such a move is a company making an acquisition for $200 million, whereas a press release or one-sided market study I simply consider noise. Companies don’t make acquisitions for hundreds of millions of dollars because it would be a nice thing to do. Press releases are easy. If you study the significant market events over the past few years it begins to paint a picture of what the future may be like. While many may think ObamaCare is the big market change I believe that the story goes well beyond healthcare reform. The health insurance market is going to change much more dramatically and while the government may be nudging things along it will be competitive market forces that will be responsible for the change.

So let’s get to the point. I believe that within 5-10 years health insurance will be delivered primarily through staff model HMO’s. These will be Kaiser-like plans where the providers of care will also be the risk takers/insurers. Individuals will pay a fee directly to a healthcare system that will be responsible for the health, wellness, and treatment of the person. Employers may still give employees money to pay for some of the cost but they won’t be in the “risk” business. We are beginning to see this evolution today through the expansion of what people are calling Accountable Care Organizations (ACOs). However, the future will go well beyond the limited risk sharing of today’s ACOs.

Four Catalysts to Change

If you had been in the health insurance business in the 80s you would say we tried this before and it didn’t work. Well today things are different. There are 4 major differences between now and then that will be the catalysts for the coming changes. They are as follows:

Change in Consumer Buying behavior

In the 80s, employers often paid for 100% of an employee’s health insurance and a large part of the family. When cost wasn’t an issue for employees they looked at provider access as the number one variable. So all the HMOs and PPOs tried to expand their networks to appease more people. Today cost is the number one issue. As a result we are seeing shrinking networks to save cost.

Expansion of Government Health Insurance Programs combined with the reduction in Medicare and Medicaid reimbursements to providers.

If I am a healthcare provider and I am getting less money to perform services on what is becoming a larger population then I need to do things different. I need to get the money from the healthy people and the people needing less care to make up for lost revenues. I would also then make more money by keeping people healthy or providing care in more cost effective settings.

Advancing Mobile Technology

With advancing technology it will be easier for providers to have real-time access to a patient’s medical information. Things like weight, blood pressure, blood glucose levels, and soon to be other health metrics can be measured in the home, via Bluetooth sent to a mobile device, and immediately be available to the primary care physician in the individual’s web-based medical/wellness record. The smart online systems can automatically notify the responsible physician of any changes in the metrics that would warrant attention. Information will be powerful in providing proper treatment in a timely manner.

Change in tax laws allowing personally purchased insurance on pre-tax basis

With Republicans taking over Congress the idea of making an individually purchased insurance policy tax deductible is now on the table. While this is not a necessary catalyst for change it certainly would put the nail in the coffin of getting employers out of the health risk business.

Not only is there a “perfect storm” forming for the coming changes but I believe the majority of the participants in today’s health care market will welcome this change. We have all heard the saying that “health care should be between the doctor and his/her patient”. We know the government wants this. I think employers, employees, and health care providers would want this too. It is the insurers and by extension benefits brokers that may not want this. However, as we all know, there is little sympathy for the insurance companies.

Employers would want this because I don’t think employers got into the health insurance business after World War II to be in the position they are in today. While I don’t think they mind giving employees money to pay for health insurance they don’t want their profit margins impacted by the health of their employees. Bad claims experience and their profits go down. Every year they agonize over the health insurance renewal deciding whether to charge their employees more or make plan changes (delivering bad news either way) or make changes to absorb increases in the business. I don’t think they want to be in the wellness business either. They may want to provide wellness programs to make people feel better, be more productive at work, or boost morale, but not to control or reduce health care costs.

Employees want this too. Do employees want their employers asking for things like health risk assessments? My health should not be my employers business. To me this is a slippery slope as it is. I do want my physician to care about my health. I want my doctor to know my weight, blood tests, and care whether I got a colonoscopy when I turned 50. I often joke that I get an email from Jiffy Lube saying that my car is due for an oil change but my doctor never sends me an email to get a check-up, test, or whatever is needed to keep my engine running the right way.

I believe doctors and other providers want this too. They want to practice health care. This would include helping their patients make the right lifestyle decisions and keeping them informed what is good for them versus what is not. They don’t want the paperwork. They don’t want third-parties telling them what to do and they are getting tired of reduced reimbursements from the government.

The Market Reacting

I am not the only one using the term “Kaiser-like”. Emanuel Ezekiel, one of Obama’s health care advisors, expects insurers to be obsolete by 2025. According to Ezekiel, “ACOs and hospital systems will become integrated delivery systems like Kaiser or Group Health of Puget Sound. Then they will cut out the insurance company middle man—and keep the insurance company profits for themselves.” (Source: new Republic – March 2014)

Now I am not going to just listen to Ezekiel Emanuel as my source. I am listening to the market. Hospital systems have been acquiring physician practices and entering the insurance business across the country. In my own backyard there was this acquisition highlighted in the Boston Globe.

State insurance regulators Friday signed off on Partners HealthCare System Inc.’s acquisition of Neighborhood Health Plan, a transaction that will put the state’s largest hospital and physician organization into the health insurance business for the first time.” (Source: Boston Globe September 2012)

In Massachusetts this is very big news. Partners HealthCare owns some of the leading hospitals in the country including Mass General and Brigham and Women’s Hospital.

Hospital systems getting into the health insurance business is not limited to Massachusetts. In NY, NJ, PA, MD, MI, and all across the country hospitals are getting into the health insurance business. (See Kaiser Health News at http://kaiserhealthnews.org/news/hospital-insurers/)

Concurrently insurance companies are getting into the health care business. According to Hospital and Health Networks Magazine January 2012 the following insurers have made health care acquisitions:

- WellPoint bought CareMore

- Optum bought Orange County’s Monarch HealthCare and two smaller IPAs

- United Healthcare acquired a multispecialty group in Nevada in 2008

- Humana purchased Concentra, which provides occupational care and other medical services

Aetna Making Moves

What I have find most interesting is the acquisitions by Aetna and some of the comments by their CEO Mark Bertolini. Let’s first look at some of the comments Bertolini has been making over the past few years.

“The end is near for profit driven health insurance companies. “The system doesn’t work, it’s broke today. The end of insurance companies, the way we’ve run the business in the past, is here.”

“We need to move the system from underwriting risk to managing populations,” he said. “We want to have a different relationship with the providers, physicians and the hospitals we do business with.”

In his presentation titled “The Creative Destruction of HealthCare” he states:

“Not too far away from now – in the next 6-7 years – 75 million Americans will be retail buyers of healthcare. And they’ll come to the marketplace with their own money and either a subsidy from their employer or a subsidy from their government. And it doesn’t much matter – they’ll be spending their money.”

Below are pictures of Bertolini with his current versus future health care relationships.

Where did the Employer circle go?

The whole Forbes article can be seen here. http://www.forbes.com/sites/danmunro/2014/02/24/aetna-ceo-bertolini-outlines-creative-destruction-of-healthcare-at-himss14/

Aetna is not just talking. If you look at Aetna’s acquisitions and partnerships over the past few years you can see that Aetna is preparing for a future that Bertolini describes in his presentation. They have spent billions of dollars acquiring technologies that can be critical to the future in managing health care and health care information including:

iTriage – Mobile App for employee to check symptoms – Find doctor – Make Appointment

ActiveHealth – View and Update PHR – Personalized Alerts and Content – Communicate with Doc

Medicity – Promotes Coordination of Care – Real-time Patient Data

(Source: Aetna 2013 Investor Presentation)

Most of these technologies and services are housed under their company Healthagen. According to Aetna’s website Aetna was ranked #52 on InformationWeek’s 2013 list of the 500 leading technology innovators, surging ahead of many of the top names associated with technological innovation. Aetna ranked first among health insurers.

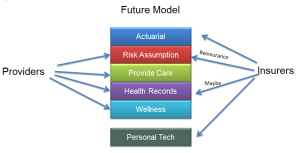

To move to this new model health care providers will need to add capabilities that insurance companies presently have. For example, hospitals provide care but they don’t have the actuarial skills to price their patient population in the event they were to get into the risk business. Many also don’t have the capital to assume risk. Those with enough capital can simply buy an insurance company. Others will have to partner with an insurance company that has the capital and reserves to share risk and provide the needed services. In the slides below I show the current and future division of services.

So if I am an insurance company I can either buy providers to stay viable or provide some products, services, or capital that the new health care systems will need. Buying hospitals or physician groups across the country can be very expensive. So it may appear that a company like Aetna is setting itself up to be the technology, actuarial, reinsurer, and other service provider for these future health care systems. I won’t claim to know if Aetna thinks the market will move as far as I am saying, which is to a Kaiser-like model, but they certainly are preparing for a different health care model.

Some may think that this is somewhat what insurance companies are doing today. Here is the critical difference though. Today the risk sharing arrangements are still in a fee for service environment. In the future a hospital system may be in close to a 100% capitation environment. Provider systems that purchase these services and/or develops a risk sharing relationship with an insurance company in such an environment can’t have two such relationships. They will need a single risk pool to properly manage the population and risk. There won’t be a Blue Cross version, a United HealthCare version, and an Aetna version of a local ACO/Staff Model system.

A good example of healthcare financing is my own healthcare. Since I moved back to Massachusetts 16 years ago I have had the same primary care physician and used the same hospital facility on a number of occasions over that time. Yet I have had 7 different health insurance programs. Assuming an average insurance premium of $10,000 per year for my family, over the 16 past years I have paid $160,000 in premiums. I understand insurance, spreading the risk, and all the other insurance arguments about where that money goes, but think of how it could be different if all $160,000 went to the system that was actually providing me and my family care.

What Benefit Brokers Can Do

Ok, so the world may change. What would I do if I were a broker today to prepare for this change? First, change does not happen easily and overnight. The whole country of health care consumers, distributors, providers will need to adapt. As a benefits broker your buyer may no longer be the employer but the employee. If this is the case then some existing services may not be needed.

- No more risk analysis/actuary and underwriting

- No more claims analysis tools

- No more wellness programs to reduce health care costs

- No more Disease Management Programs

- No more company medical renewals

Before someone points out the obvious to me I will say that I do know most groups with less than 100 employees are community rated and those over 100 employees are experience rated. Small employers are still faced with balancing budgets based on their health care renewal. This anxiety will go away.

Most of these types of services are a core competency of many of the national and larger independent benefits brokerage organizations. These services are viewed as key differentiators. For these firms change may be even more dramatic because providing these types of analytical skills is part of their culture.

So let’s talk about the things brokers can do. I am going to break this down to a list of tasks.

- Understand What the Players in Your Market Are Doing – Brokers should start analyzing their local medical market and see what the providers are doing in this area. Have they made acquisitions? Have they created new partnerships? What is their leadership saying publicly? Whatever they say or do, believe them.

- Add Employee Call Center – Employers will welcome the support in helping employees move to a new environment. Provider systems will welcome and pay for the support in helping those same employees navigate the market.

- Add Personal Financial Consulting – It is estimated that close to 40% of employees lose some productivity at work due to financial stress. The health care insurance purchase is going to be a major decision for an employee and it should be made in the context of an employee’s entire financial position.

- Understand the New Technologies – How many of you that have read this up to this point understand what Aetna’s technologies for the consumer are? Do you know how to Bluetooth your weight from a scale to a smartphone? The place of employment can also be a great place to help employees with technology to track health information. Could an employer have a scale at work that is Bluetooth enabled to send a person’s weight to their Smartphone? Could the employer have a blood pressure machine at work? How about setting up a private room with teleconferencing capabilities so an employee can consult a doctor face to face via the web without leaving the place of employment? Could a broker make themselves available to consult employees one on one as to how this whole system will work?

- Develop Technology Engagement and Education Strategy – After you learn what you need to know in number 4 above are you ready to deliver. I believe the provider systems (the new Kaisers) will welcome the opportunity to educate the population through the employer. At the employer level you can reach a large amount of people fairly easily. And the employers will care that their employees understand this new health care delivery system. Employers don’t want stressed employees because stressed employees are not as productive. I believe employers and these new provider systems will pay to help and automate these individual consumers.

- Invest in New Internal Technology and Processes – If your entire infrastructure is geared around engaging the employer then things will need to change. Can you record a phone call? Can you engage in online chat with an employee? Are you prepared to sell individual insurance? To sell a high volume of individual policies and service employees you will need extremely efficient internal operations.

- Start Thinking About Helping Employers Exit the Risk Business – Rather than advise employers how to control costs and mitigate risk should they start advising them on how to get out of the risk business? I guess Private Exchanges and defined contribution plans are the start. However, if the health care market changes then this will also change fast because there will be more options for the employer to get out.

- Engage New Providers – Carrier reps are always calling on brokers, but these new organizations may not call on brokers in the same way. You may need to reach out to them. If you have something of value for the new provider system such as some of the things listed above would they have an interest in paying you for your services? You will need to engage them.

Numbers 1 through 7 may sound fine but getting there is the tough part. To move to this new model it will require brokers to invest in technology and people. To attract the provider systems by providing some value benefits firms will need to have the services, size, and scale to deliver. Most independent benefits firms either don’t have the capacity or capital to move to this model. They will either have to sell to a larger firm or join forces with their peers who share the same vision and are willing to collectively invest in preparing for the future. The national firms and larger independent firms with the capital and resources will need to have the will to change.

In today’s environment many brokers may not feel the need to make these changes. Other firms have already started preparing for a much different future. For example several of the national firms have opened call centers for employees. Whether that is for a future market I have described or simply to service employees today I don’t know, however it is a sign the benefits game is changing.

I may not end up being right with my market predictions, but my advice is to pay close attention. There is change going on out there and I think a picture of the future is being drawn that looks much different from the health care market today.

Joe,

Extremely well written and I completely agree.

I will be interested in the feedback that you receive.

Best,

Bill

Bill Bishop

Executive Vice President

Benefit Group

Lockton Companies, LLC

8110 E. Union Ave., Suite 700

Denver, CO 80237-2984

Tel: 303.414.6449

Fax: 303.865.6449

E-mail: william.bishop@lockton.com

CA Insurance License #OF15767

Securities offered through Lockton Financial Advisors, LLC a registered broker-dealer and member FINRA, SIPC. Investment advisory services offered through Lockton Investment Advisors, LLC, a SEC registered investment advisor. For California, Lockton Financial Advisors, LLC, d.b.a. Lockton Insurance Services, LLC, license number 0G13569.

This message and any attachments may contain information that is privileged, confidential and exempt from disclosure under applicable law. If you are not the intended recipient (or not authorized to act on behalf of the intended recipient) of this message, please do not disclose, forward, distribute, copy, or use this message or its contents. If you have received this communication in error, please notify us immediately by return e-mail and delete the original message from your e-mail system.

Nothing in this message should be construed as legal advice. Lockton may not be considered your legal counsel and communications with Lockton’s compliance services group are not privileged under the attorney-client privilege.

Circular 230 Disclosure: To comply with regulations issued by the IRS concerning the provision of written advice regarding issues that concern or related to federal tax liability, we are required to provide to you the following disclosure: unless otherwise expressly reflected herein, any advice contained in this document (or any attachment to this document) that concerns federal tax issues is not written, offered or intended to be used, and cannot be used, by anyone for the purpose of avoiding federal tax penalties that may be imposed by the IRS or promoting, marketing or recommending to another party any matters addressed in this document or any attachment

LikeLike

Joe – great stuff!

LikeLike

Thanks Tim.

LikeLike

Pingback: Benefits Brokers – Part of the Problem or Part of the Solution? | JOE MARKLAND

The Star Trek version of medicine may be upon us sooner than most realize.Your article is on point. Smart phones and other technology are now available to make it happen . You won’t have to rush to the doctor you can use your smart phone etc. WOW exciting future. We need to be ready to be a part of it.

LikeLike

I think we will see some comprehensive solutions but I don’t think the new giants will be interested in the “mom and pop” main street business who will be increasingly hard pressed to turn to alternatives like employee leasing.

Certainly the damage to the broker community is already significant. Going forward the survivors will have to be “nimble” to say the least.

LikeLike

The system could move to provider-to-consumer, or it could move from provider-to-employer. In either case, the insurance company will have a smaller role- but that is not necessarily bad, because the providers (really, clinically integrated networks of providers) will be accountable for both cost and quality- which, by the way, is a model that many of them like, and that is in the consumer’s interest.

LikeLike

Pingback: Two Things Zenefits is Doing That Most Brokers Aren’t | JOE MARKLAND

Pingback: My Bold Predictions About the Future of the Benefits Business – A Summary | JOE MARKLAND

Pingback: The End of Employer-based HealthCare – An Update | JOE MARKLAND

Pingback: A Zombie Movie and the Relationship to Trump’s HRA Changes | JOE MARKLAND